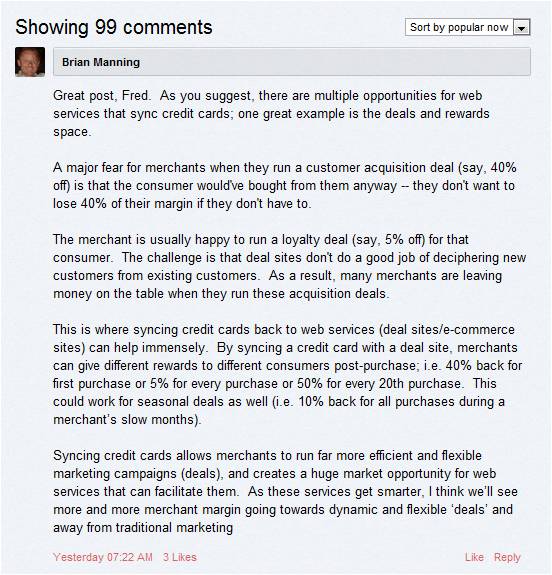

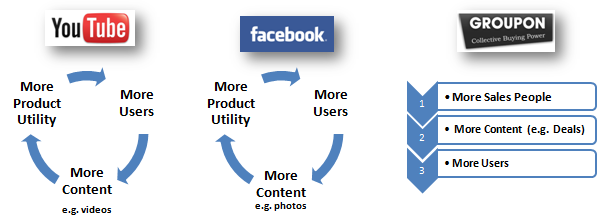

Most of us know that a huge trend in e-commerce is the personalization of websites and email content. You'll log-in into a site and you'll only see the things that you want. You'll receive emails that are personalized to your interests, you'll only see the things that matter to you.

While this sounds wonderful, it simply doesn't work well right now. By "well" I mean it isn't profitable.

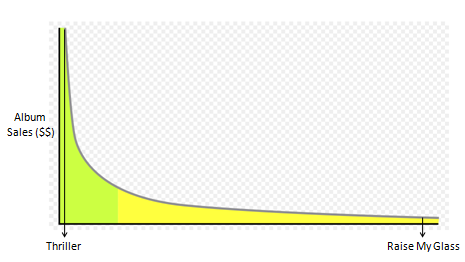

Here's a perfect example. iTunes knows literally EVERYTHING about my taste in music. They know my favorite songs and artists and my least favorite songs and artists. They know the artists and albums and videos I've purchased. And those that I've viewed, but chosen not to buy. They know enough to have give me the most personalized music shopping experience on earth.

But what do I see when I log-in to iTunes? Huge display ads for albums from Lady Gaga, Katy Perry and Pitbull -- three artists I've never dreamed of buying.

Same thing with Amazon. They know everything about my online shopping habits but all I can see on the homepage is a huge display ad for the new Kindle.

The reason for this is simply that personalization doesn't work in the short term. And marketing managers that decide what goes on the homepage need to hit their numbers this week and this month and this quarter.

I can almost imagine the conversation at Apple:

CEO: Hey, we know so much about our users, why don't we show them albums that are relevant to them on the homepage? Won't they convert better?

iTunes Marketing Manager: Well yes, they'll convert better but the incremental revenue from the better conversion doesn't even come close to the incremental revenue we get in fixed marketing fees for putting Lady Gaga on the homepage. In addition, Lady Gaga's label pays us a larger revenue share per album. Also, if we sell 50,000 Lady Gaga albums this week, we get a $1 million bounty from her label. So while our homepage to purchase conversion may increase with personalization, it simply won't make up for the marketing revenue we're getting by broadcasting her album to all of our users.

CEO: But won't this turn some users off? Won't they go somewhere else if we don't show them what they want right away?

iTunes Marketing Manager: I suppose that's true, but hey, I have a big goal this month that I need to hit. I can't worry about that now.

Of course I'm completely making up the facts and numbers in this conversation, but this is the logic that's driving decision making for many web services that can personalize but choose not to. It simply isn't profitable yet. And most companies aren't willing to make the short term sacrifice to provide a better shopping experience in the long run.

That said, I do believe at some point the large web services' personalization tools will get smart enough where the increases in conversions from personalizing a site will outweigh their fixed marketing revenue. But it's pretty clear to me that that reality is pretty far off.